Bubble Index

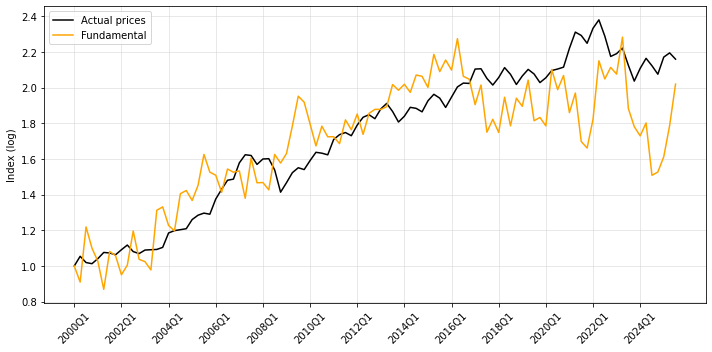

Housing Lab has updated its Bubble Index using data for 2025 Q3. The update indicates that Norwegian real house prices were overvalued by around 7 percent in 2025 Q3. After a prolonged period of overvaluation, the gap has begun to narrow.

This development reflects lower policy rates from Norges Bank, which have declined from 4.5 percent in Q1 to 4.0 percent in Q3. At the same time, household income has grown steadily while housing supply remains sluggish. Together, these factors are pushing fundamental house prices upward.

We expect the gap to narrow further if income growth remains solid, supply continues to stagnate, and the central bank proceeds with additional policy rate cuts. Overall, our assessment is that there are currently few signs of overvaluation in the housing market at the national level.

About the index

Housing Lab estimates fundamental house prices for Norway and compare them to the evolution of actual house prices. Fundamental house prices are determined by real per capita income, real after tax interest rates, and the housing stock per capita. Our estimates of fundamental prices are updated and published on a quarterly basis. Due to lags in the construction of the National Accounts data used to estimate fundamental prices, our estimates lag by one quarter. The underlying methodology is based on published research and is documented in Anundsen (2019).