Bubble Index

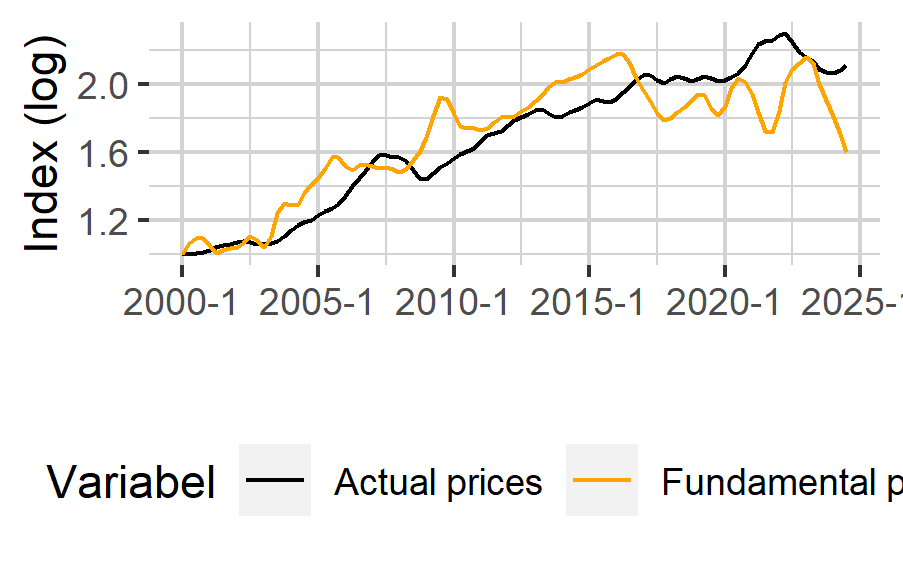

Housing Lab has updated its Bubble Index based on data for 2024Q3, see Figure 1. The update suggests that Norwegian real house prices were overvalued by 32 percent in 2024Q3 – up from about 18 percent in 2024Q2. The main contributing factor explaining the overvaluation is the increase in real interest rates due to a combination of higher nominal rates and lower core inflation – both pushing the real rate in the same direction. Higher real interest rates imply lower fundamental house prices. The underlying econometric model suggests that an increase in the real interest rate of one percentage point is associated with a fall in fundamental prices of nearly 14 percent. Lower fundamental prices imply an increase in the gap between actual and fundamental prices.

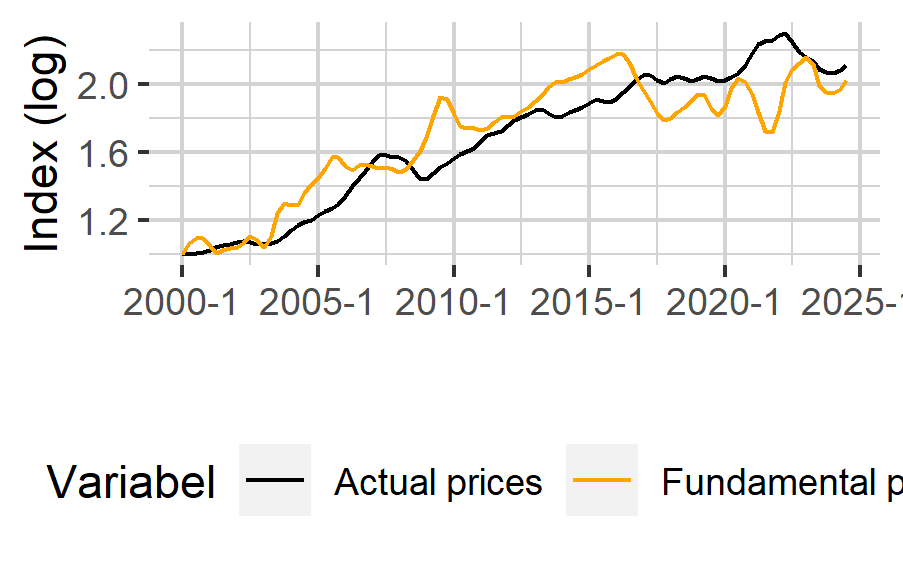

To shed some light on this, we estimated the quasi-counterfactual gap between actual and fundamental prices under the assumption that the real interest rate remained unchanged throughout 2024, see Figure 2.

We believe that house prices will remain overvalued until inflation stabilizes around the inflation target and/or when Norges Bank starts lowering the policy rate. Low building activity, high wage growth and lower interest rates will eventually push in the other direction, so that fundamental prices will start increasing again in 2025.

Figure 1

Figure 2

About the index

Housing Lab estimates fundamental house prices for Norway and compare them to the evolution of actual house prices. Fundamental house prices are determined by real per capita income, real after tax interest rates, and the housing stock per capita. Our estimates of fundamental prices are updated and published on a quarterly basis. Due to lags in the construction of the National Accounts data used to estimate fundamental prices, our estimates lag by one quarter. The underlying methodology is based on published research and is documented in Anundsen (2019).